US Wholesale Inflation Sees Significant Slowdown in February: A Positive Sign for the Economy

Table of Contents

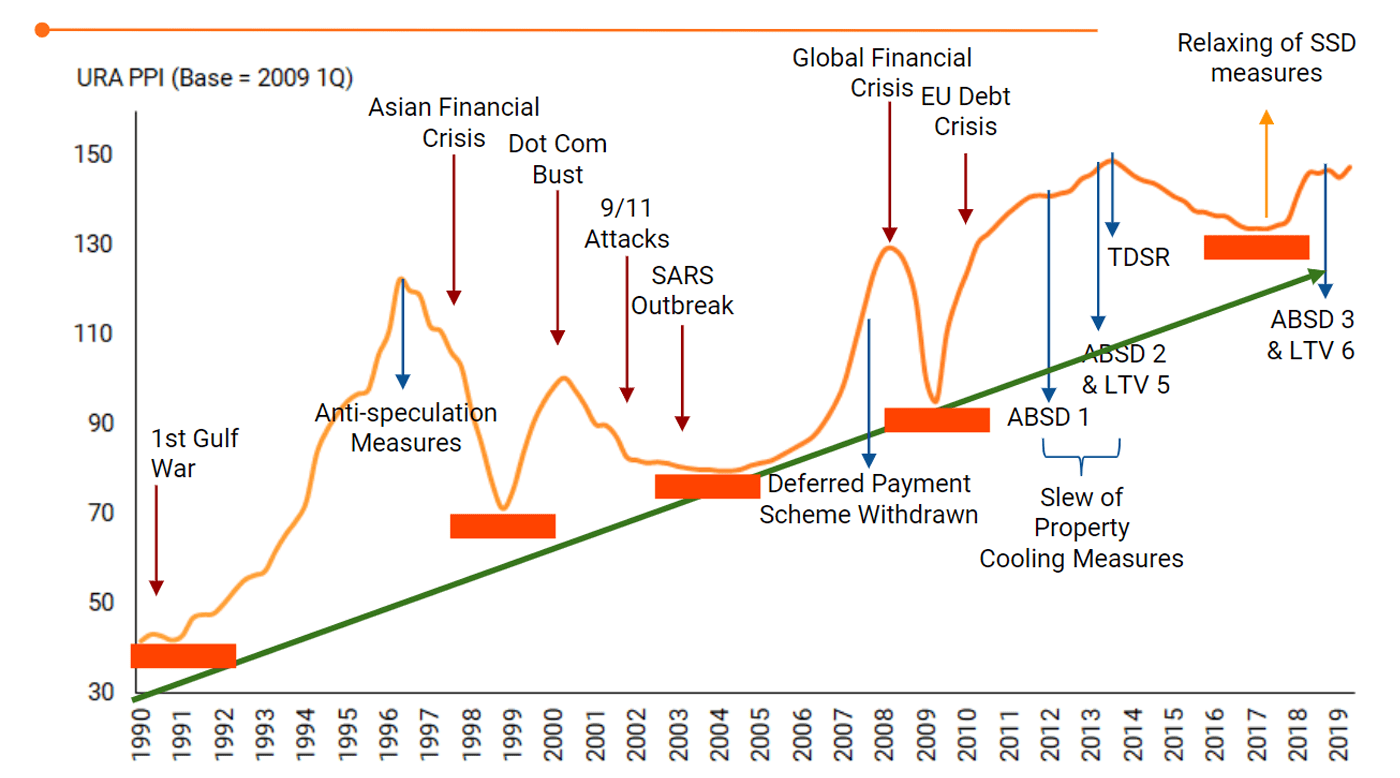

- How Resilient Is Singapore Property - Is It Profitable To Buy During ...

- What is The Producer Price Index (PPI) in the Forex Economic Calendar?

- Producer Price Index (PPI) Explained - FxExplained

- Guidelines for Conducting the PPI Data Validation | ForChildren

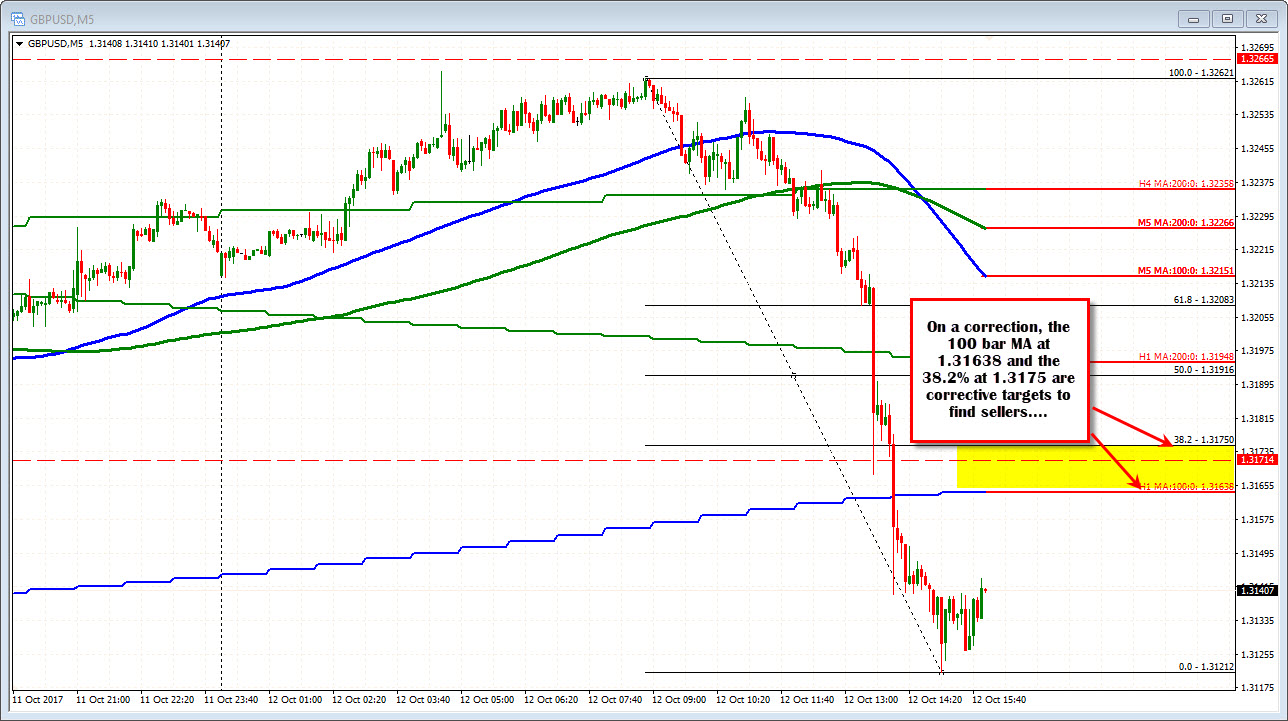

- Dollar gets a boost after PPI data

- Producer Price Index Ppi Sign Gold Letters Background Chart Oil — Stock ...

- PPI INDEX IMPORT - C2011 Industrial gases 2015=100 - Office for ...

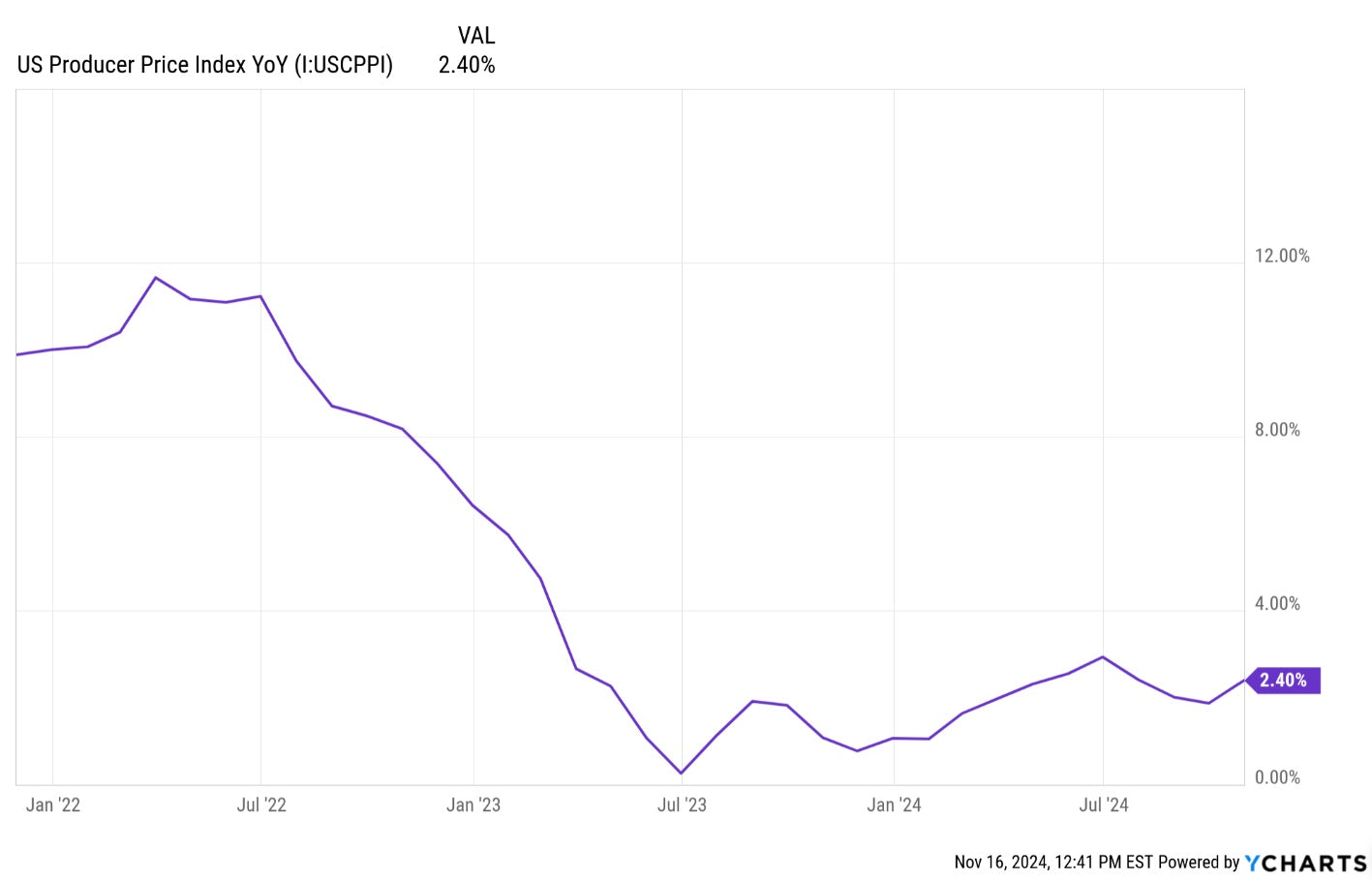

- PPI (Producer Price Index) Year-Over-Year Continues To Creep Higher

- Decoding Economic Trends: A Deep Dive into the Producer Price Index ...

- 1 Historical Trend of PPI Projects by Region (over the period ...

The slowdown in wholesale inflation is largely attributed to a decrease in energy prices, which fell by 2.4% in February. This decline in energy prices has helped to offset the increase in food prices, which rose by 1.3% during the same period. The core PPI, which excludes food and energy prices, rose by 0.2% in February, indicating that underlying inflation pressures remain relatively subdued.

Implications for the US Economy

The slowdown in wholesale inflation is also good news for consumers, who will not have to bear the brunt of higher prices. With prices rising at a slower pace, consumers will have more disposable income to spend on goods and services, which could lead to increased demand and economic growth. Additionally, a slowdown in inflation could also lead to increased consumer confidence, as people will feel more secure about their purchasing power.

Global Implications

In conclusion, the slowdown in US wholesale inflation in February is a positive sign for the economy. With inflationary pressures easing, the Federal Reserve is likely to maintain its dovish stance on interest rates, which could lead to increased borrowing and spending by consumers and businesses. The slowdown in inflation is also good news for consumers, who will not have to bear the brunt of higher prices. As the US economy continues to grow, it is likely that wholesale inflation will remain subdued, which could lead to increased economic growth and stability.